Insurtech Market Forecast 2025 | Share, Trends, Growth Analysis by 2033

- by vishalguptaimarc

- April 14, 2025

Market Overview:

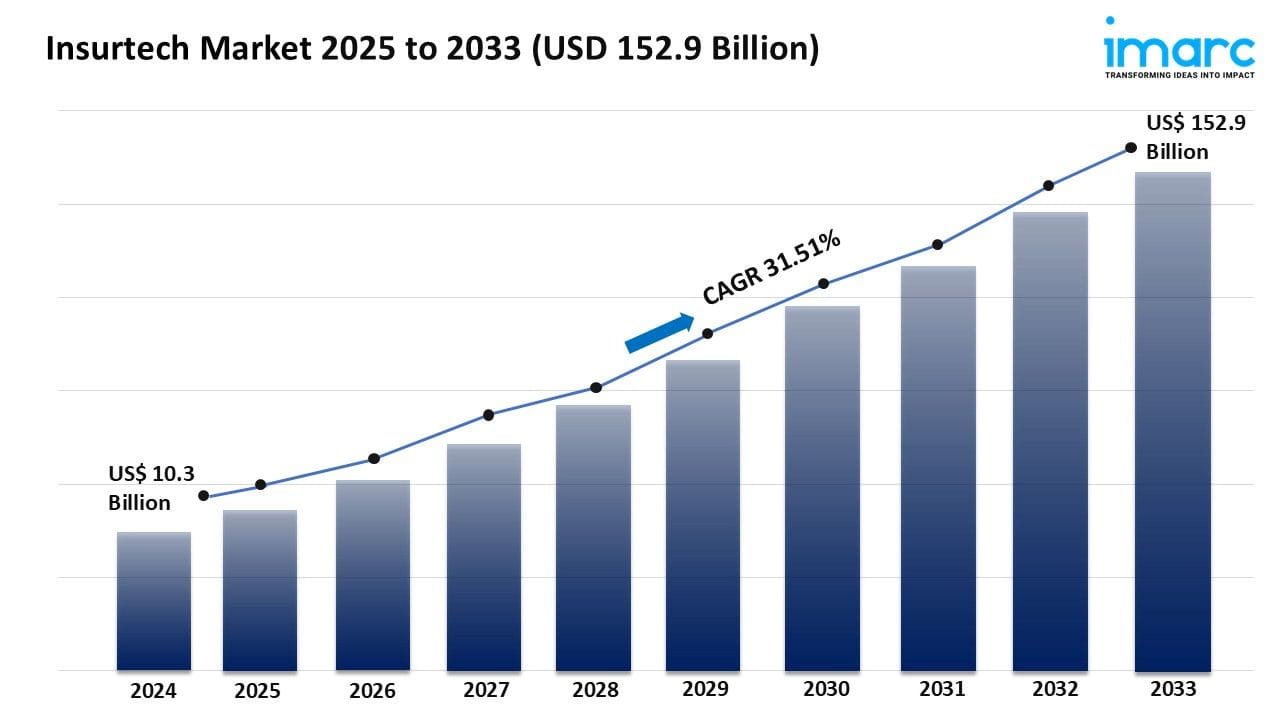

- The global insurtech market size was valued at USD 10.3 Billion in 2024.

- The market is expected to reach USD 152.9 Billion by 2033, exhibiting a growth rate (CAGR) of 31.51% during 2025-2033.

- North America leads the market, accounting for the largest insurtech market share.

- The Health segment dominates the market with a 25.7% share in 2024, driven by rising healthcare costs, preventive care trends, and the adoption of wellness programs, telemedicine, and data-driven solutions to manage expenses and improve outcomes.

- Cloud computing hold the biggest share in the insurtech industry.

- AI, ML, big data, and blockchain are driving innovation, efficiency, and personalized solutions in the insurtech industry.

- Demand for convenience, transparency, and tailored services is pushing insurtech firms to adopt digital platforms and usage-based policies.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/insurtech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Insurtech Industry:

- Technological Advancements:

The insurtech sector is thriving, thanks to technology. Artificial intelligence and machine learning are leading the way. They help insurance firms to improve their operations and make them more efficient. Big data analytics is changing how companies serve their customers, creating better experiences than ever before. This technology lets insurers craft products that fit individual needs. It helps them better assess risk, automate underwriting, and spot fraudulent claims easily. Insurtech firms also use blockchain for secure and clear transactions. As these technologies keep improving, they're changing the industry, driving innovation and growth.

- Changing Consumer Expectations:

At present, the insurtech sector is responding to shifting consumer expectations around the world. Modern consumers increasingly demand convenience, transparency, and personalized services. Insurtech companies are leveraging digital platforms and mobile apps to offer on-demand insurance solutions, allowing customers to purchase, manage, and file claims seamlessly. Real-time data and telematics devices allow insurers to develop insurance policies based on individual usage and preferences. By tailoring their offerings to meet changing consumer demands, insurtech firms are fueling industry growth.

- Regulatory Environment:

The regulatory landscape has a significant impact on the growth of the insurtech industry. Governments and regulatory bodies worldwide are adapting to the shift towards digital insurance. To keep up, regulations are being revised to accommodate innovations in insurtech, with a focus on data security, consumer protection, and fair competition. A supportive regulatory environment with clear guidelines helps startups and established insurers enter the market more easily. However, overly strict or unclear regulations can slow market growth. To thrive in this rapidly changing sector, insurtech companies must skillfully navigate these regulatory hurdles.

Leading Companies Operating in the Global Insurtech Industry:

- Clover Health LLC

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco (Aurum PropTech Limited)

- Oscar Insurance Corporation

- Quantemplate

- Shift Technology

- Travelers Companies, Inc.

- Wipro

- ZhongAn Online P&C Insurance Co. Ltd.

Insurtech Market Report Segmentation:

By Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Based on the type, the market has been classified into auto, business, health, home, specialty, travel, and others.

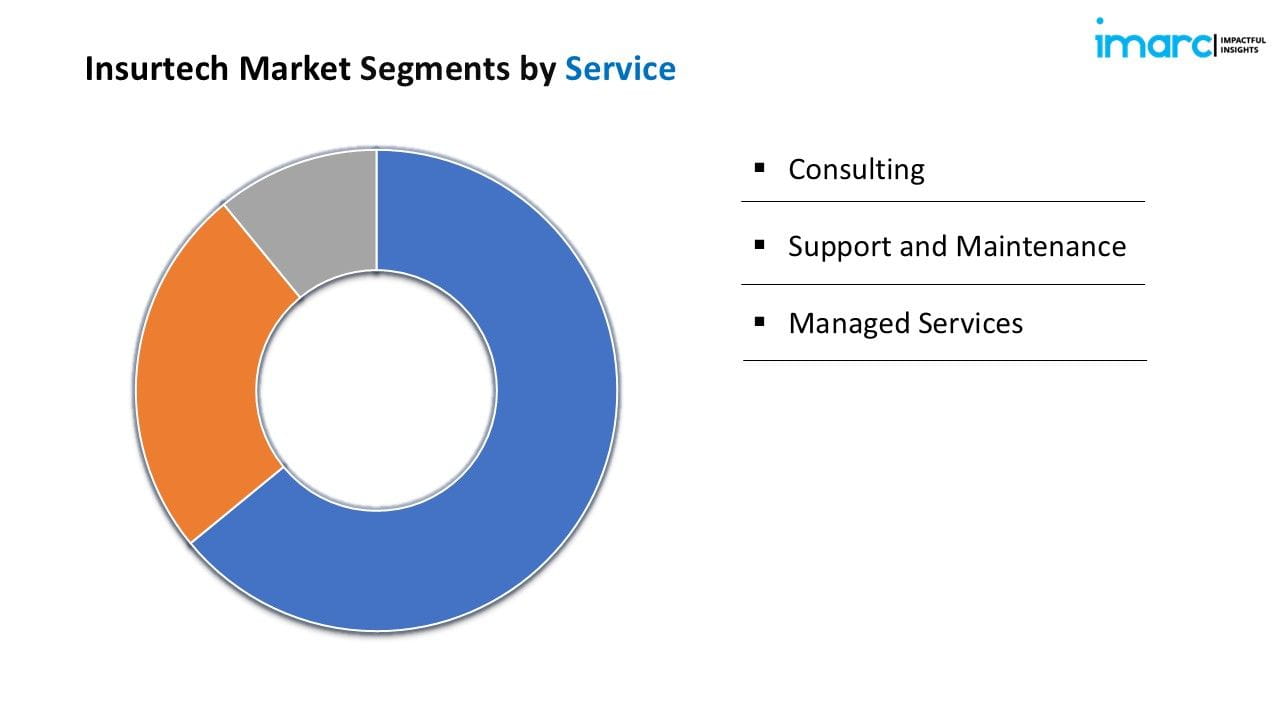

By Service:

- Consulting

- Support and Maintenance

- Managed Services

On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

By Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Cloud computing accounts for the largest market share due to its scalability, cost-efficiency, and ability to provide insurers with seamless access to data and applications, enabling streamlined operations and enhanced customer experiences.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America's dominance in the insurtech market is attributed to its robust technological infrastructure, high adoption rates of digital solutions, and well-established insurance industry, making it a fertile ground for the growth of insurtech companies.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145