Digital Banking Platform Market Size, Trends, Growth and Forecast 2025-2033

- by vishalguptaimarc

- January 8, 2025

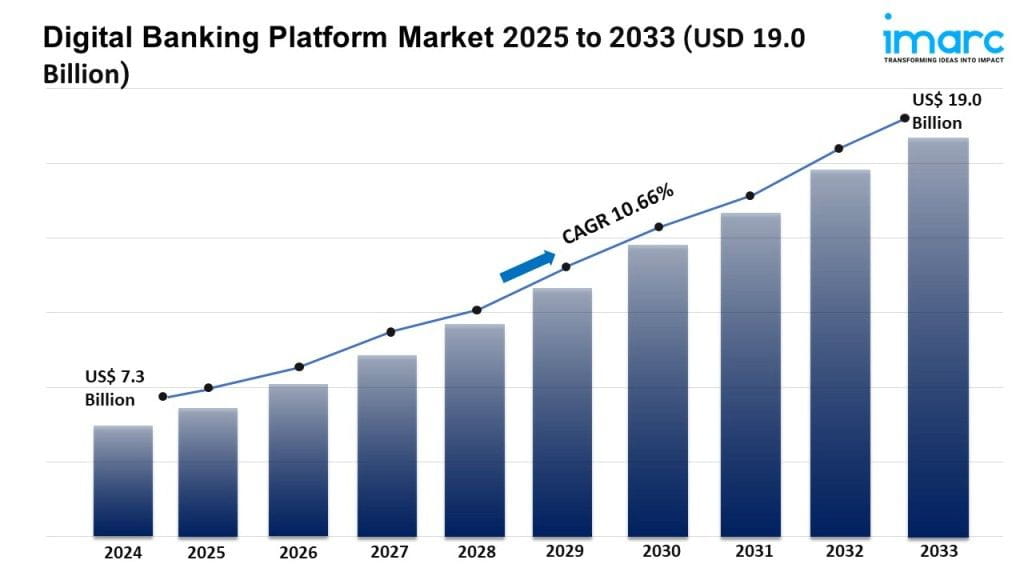

IMARC Group's report titled "Digital Banking Platform Market Report by Component (Solutions, Services), Type (Retail Banking, Corporate Banking), Deployment Mode (On-premises, Cloud-based), Banking Mode (Online Banking, Mobile Banking), and Region 2025-2033". The global digital banking platform market size reached USD 7.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.66% during 2025-2033.

Grab a sample PDF of this report: https://www.imarcgroup.com/digital-banking-platform-market/requestsample

Factors Affecting the Growth of the Digital Banking Platform Industry:

-

- Enhanced Experience:

In today's fast-paced world, people need banking that fits their lifestyle. The rise of digital banking platforms is changing the game. They offer busy individuals accessible and personalized experiences. This shift is driving a positive market outlook, making every click count towards convenience. As technology moves forward, it reshapes our financial landscape. It provides endless possibilities for the modern consumer. Digital banking platforms meet these needs by providing 24/7 services that are tailored to each person's financial habits and preferences. This includes features like mobile banking apps for on-the-go access, transaction notifications in real time, and financial management tools. The need for convenience, speed, and customization is driving traditional banks to use digital platforms, which help them meet user expectations and boost satisfaction and retention.

-

- Technological Advancements:

Artificial intelligence (AI) and machine learning (ML) enable sophisticated data analysis for personalized user services and risk management. Blockchain technology offers enhanced security and transparency for transactions. Moreover, cloud computing provides a scalable infrastructure that is crucial for managing the vast amount of data processed by banks daily. These technological advancements not only streamline operations but also enable banks to innovate and offer new services. Furthermore, advancements in cybersecurity, including encryption technologies, biometric data for authentication, and advanced threat detection systems, are crucial for protecting sensitive financial information and maintaining individual trust.

-

- Regulatory Support:

Governing agencies of various countries are recognizing the importance of digital transformation in banking. Various regulations encourage the adoption of open banking, which mandates banks to share financial data with third-party providers with individual consent. This is leading to increased competition and innovation, giving individuals more choices and better services. In line with this, regulatory support often comes with guidelines that ensure these digital transitions maintain high security and compliance standards, facilitating a safer and more robust digital banking environment.

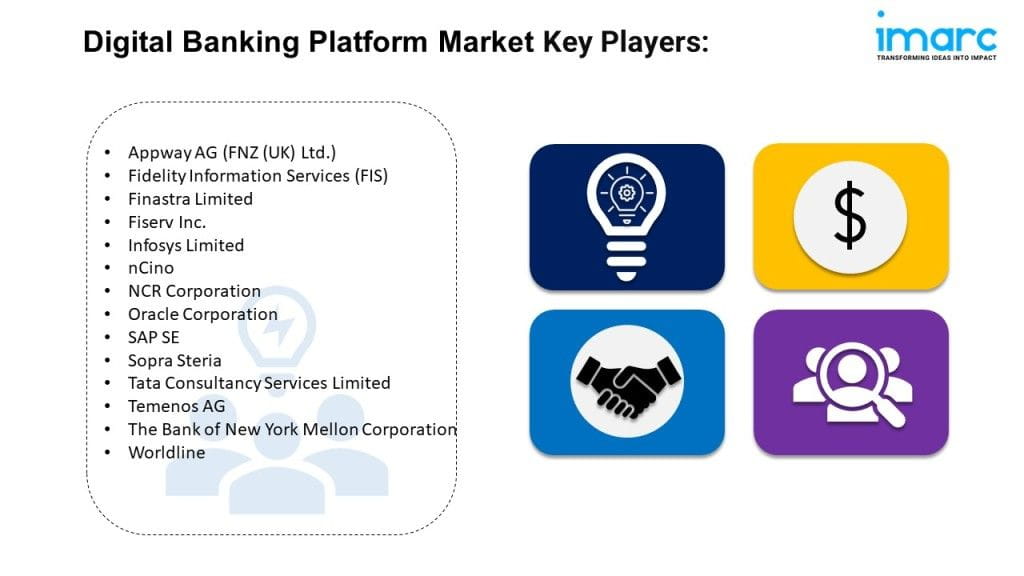

Leading Companies Operating in the Global Digital Banking Platform Industry:

-

- Appway AG (FNZ (UK) Ltd.)

-

- Fidelity Information Services (FIS)

-

- Finastra Limited

-

- Fiserv Inc.

-

- Infosys Limited

-

- nCino

-

- NCR Corporation

-

- Oracle Corporation

-

- SAP SE

-

- Sopra Steria

-

- Tata Consultancy Services Limited

-

- Temenos AG

-

- The Bank of New York Mellon Corporation

-

- Worldline

Digital Banking Platform Market Report Segmentation:

By Component:

-

- Solutions

-

- Services

Solutions represent the largest segment on account of their flexible and customizable offerings to financial institutions.

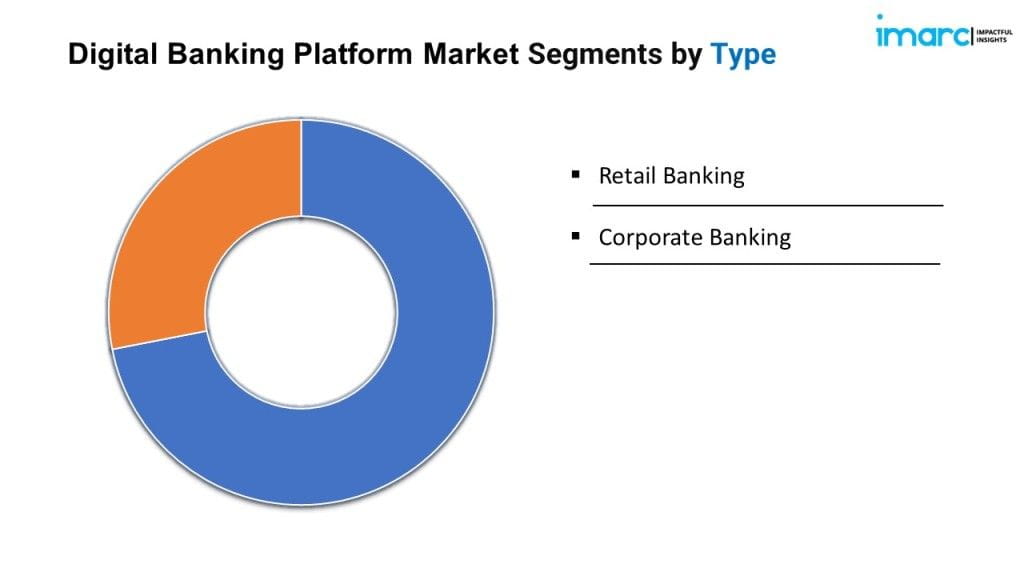

By Type:

-

- Retail Banking

-

- Corporate Banking

Retail banking holds the biggest market share, driven by the rising demand for convenient and personalized banking services.

By Deployment Mode:

-

- On-premises

-

- Cloud-based

On-premises account for the largest market share due to their ability to cater to the specific needs and preferences of financial institutions that prioritize maintaining control and security over their infrastructure and data.

By Banking Mode:

-

- Online Banking

-

- Mobile Banking

Online banking exhibits a clear dominance in the market as it enables financial institutions to offer a wide range of services to individuals through digital channels.

Regional Insights:

-

- North America (United States, Canada)

-

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

- Latin America (Brazil, Mexico, Others)

-

- Middle East and Africa

North America enjoys a leading position in the digital banking platform market, which can be attributed to the thriving banking sector.

Global Digital Banking Platform Market Trends:

The rise of fintech startups and neobanks has introduced a wave of innovation in the financial services industry, which is prompting traditional banks to accelerate their digital transformation. These newer entrants often focus exclusively on digital platforms, offering highly competitive products and services such as zero-fee accounts, instant loans, and superior experience to individuals.

In addition, digital banking platforms play a crucial role in improving financial inclusion by reaching underserved and unbanked populations, especially in emerging markets. Mobile banking allows access to banking services in remote areas where branch access is limited.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145