Micro Lending Market Size, Share, Industry Demand And Report 2024-2032

- by vishalguptaimarc

- December 10, 2024

Global Micro Lending Industry: Key Statistics and Insights in 2024-2032

Summary:

-

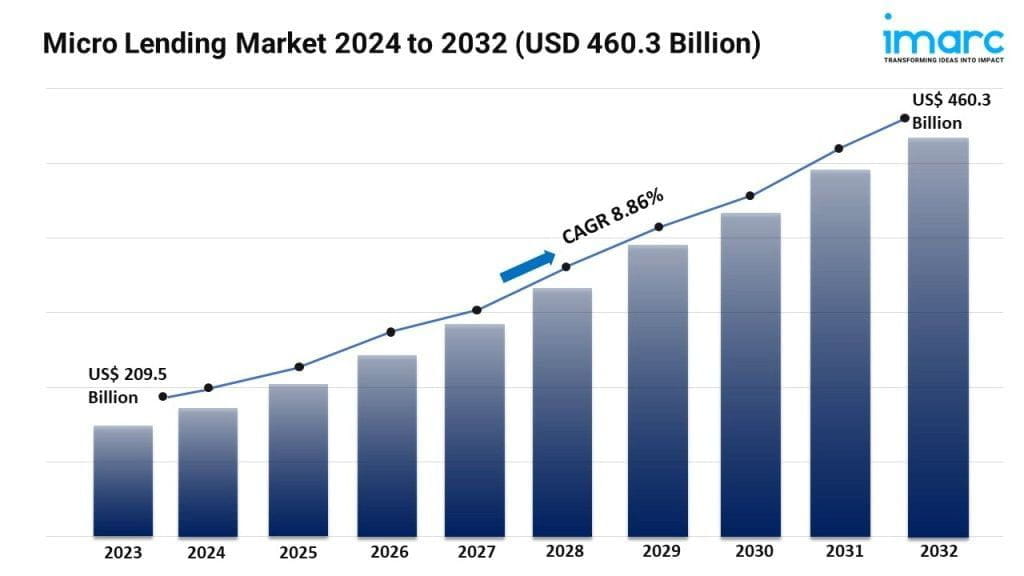

- The global micro lending market size reached US$ 209.5 Billion in 2023.

-

- The market is expected to reach USD 460.3 Billion by 2032, exhibiting a growth rate (CAGR) of 8.86% during 2024-2032.

-

- Asia Pacific leads the market, accounting for the largest micro lending market share.

-

- Banks account for the majority of the market share in the provider group since they are reputable financial organizations with a wide reach.

-

- Small businesses account for the largest proportion of the microlending industry.

-

- Financial inclusion programs are the key drivers of the microlending sector.

-

- Fintech innovations and support for small and medium-sized firms (SMEs) are transforming the microlending industry.

Industry Trends and Drivers:

-

- Financial Inclusion Initiatives:

Countries' agencies and banks are now prioritizing financial inclusion to combat inequality and poverty, especially in emerging markets. Micro-lending is crucial here. It gives credit access to those often excluded from banks, like small business owners, farmers, and low-income individuals. Financial inclusion programs often have regulatory support. This makes it easier for micro-lenders to operate. This push is helping millions of people to start businesses or meet personal financial needs. Global development groups are teaming up with local micro-lenders to reach underserved communities. This effort expands the market. Micro-lending offers small, short-term loans with low collateral. It bridges the financial gap for marginalized populations, promoting economic growth and social mobility.

-

- Support for Small and Medium Enterprises (SMEs):

The micro-lending market benefits significantly from the growing focus on supporting small and medium-sized enterprises (SMEs) globally. SMEs frequently struggle to secure financing through traditional banking channels due to high collateral requirements and stringent credit checks. Micro-lenders fill this gap by offering small and unsecured loans that are more suited to the needs of small businesses. Many countries' agencies and governments are increasingly promoting innovation and entrepreneurship. They often partner with microlenders to offer easy funding. This trend is especially notable in developing nations. There, small and medium-sized enterprises (SMEs) are crucial for innovation, job creation, and economic growth.

-

- Technological Advancements in Fintech:

Digital platforms, mobile banking, and data analytics allow micro-lenders to offer quick, low-cost loans to remote borrowers. Fintech innovations such as automated credit scoring, digital wallets, and blockchain technology are simplifying the assessment of borrower risk and speeding up fund disbursement. Furthermore, mobile apps enhance user experience, boosting adoption rates. This is particularly true in developing regions with limited traditional banking. There is a rise in the number of peer-to-peer lending platforms, which is empowering individual lenders to participate. Technology is transforming micro-lending into a scalable business. It is lowering costs and improving risk management. This makes it attractive to new and established players.

Grab a sample PDF of this report: https://www.imarcgroup.com/micro-lending-market/requestsample

Micro Lending Market Report Segmentation:

By Provider:

-

- Banks

-

- Micro Finance Institute (MFI)

-

- NBFC (Non-Banking Financial Institutions)

-

- Others

Banks dominate the market due to their extensive financial resources, established customer trust, and comprehensive range of financial products and services.

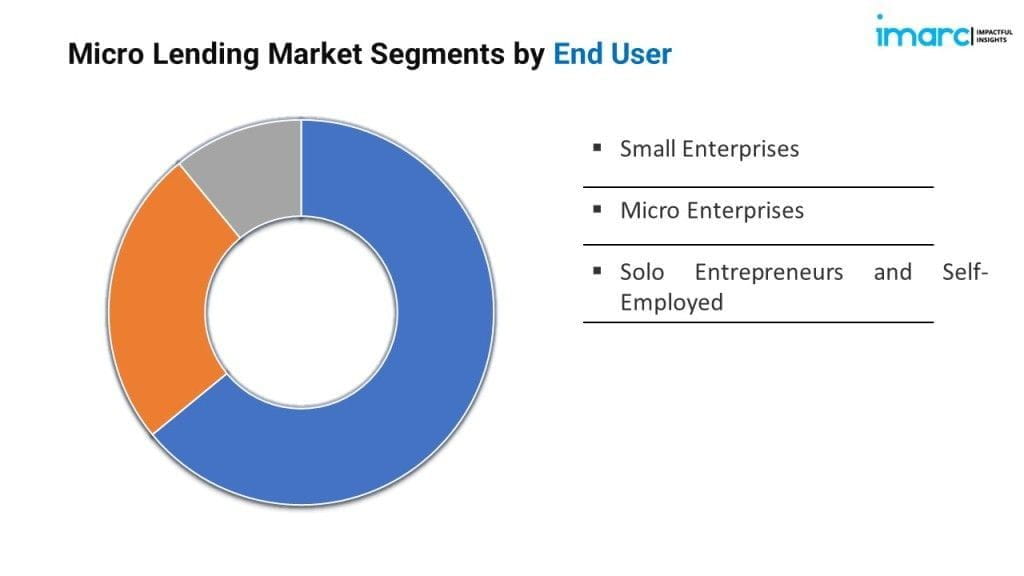

By End User:

-

- Small Enterprises

-

- Micro Enterprises

-

- Solo Entrepreneurs and Self-Employed

Small enterprises represent the largest market segment as they are agile, adaptable, and often specialize in niche markets, allowing them to swiftly respond to changing consumer preferences and market dynamics, thus gaining a competitive edge.

Regional Insights:

-

- North America (United States, Canada)

-

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

- Latin America (Brazil, Mexico, Others)

-

- Middle East and Africa

Asia Pacific’s dominance in the micro lending market is attributed to its vast population, burgeoning middle class, and increasing adoption of digital financial services.

Top Micro Lending Market Leaders:

The micro lending market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

-

- American Express Company

-

- BlueVine Inc.

-

- Funding Circle

-

- Lendio Inc.

-

- Lendr

-

- Manappuram Finance Limited

-

- NerdWallet

-

- On Deck Capital (Enova International)

-

- StreetShares Inc. (MeridianLink)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145